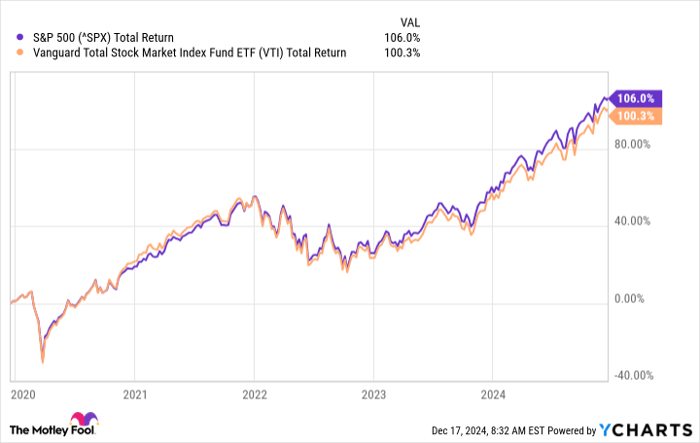

This year has been an exceptional one for the markets as the S&P 500 has risen by around 27%. Many growth stocks are trading near or at their highs as well. But for some investors, there are definitely concerns about whether the market is perhaps a bit too hot, and that tech stocks and those that are benefiting from advances in artificial intelligence (AI) have become wildly overvalued.

If you fall into that category, then there may be an exchange-traded fund (ETF) that could be a more appealing option for you. One ETF that offers significant diversification and that may outperform the S&P 500 next year is the Vanguard Total Stock Market Index (NYSEMKT: VTI).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

A potentially softer landing for investors?

Historically, the Vanguard Total Stock Market Index has performed similarly to the S&P 500. But the advantage the Vanguard fund has is that with over 3,600 holdings, it's a much more diversified option for investors. And that can be crucial in a year when certain high-priced stocks may be overdue for a correction but the overall market may still perform well.

Economic conditions remain strong and a recession isn't necessarily inevitable. But if a slowdown does happen, one sector that may be particularly vulnerable is tech, where feverish spending on AI has allowed stocks to rise to obscenely high valuations. And crypto stocks have also been soaring due to Bitcoin climbing above $100,000.

A broader mix of stocks can better position the Vanguard fund to do well under more challenging conditions. One of the benefits of greater diversification is that you can enjoy more stability, but by doing so, you might also have lower returns in strong years than if you went with a more concentrated portfolio. Heading into 2025, that's a trade-off some investors may be willing to make.

The Vanguard fund has less exposure at the top

Many ETFs that are doing well this year have significant holdings in Apple, Microsoft, and Nvidia, the three most valuable stocks on the market. Even if you like these stocks, however, it may not be a bad idea to at least modestly reduce your exposure to them so that too much of your investment or portfolio isn't riding on just three stocks.

In the Vanguard fund, those three tech giants account for 16.7% of its total weight. That's slightly lower than the SPDR S&P 500 ETF, which tracks the S&P 500. Those three stocks make up 20.2% of its holdings. While the difference may not be a massive one, it can still make this Vanguard fund a little less vulnerable to a potential correction in those high-valued holdings.

Investing in the total stock market can be a good way to reduce risk

If you're not sure what to invest in right now, the Vanguard Total Stock Market Index can make a lot of sense for you given its broad diversification and low fees -- it has an expense ratio of just 0.03%. The passively managed fund will give investors exposure to not only the big names in the market, but also all sorts of investments, including small-, mid-, and large-cap stocks.

Even if you're not necessarily worried about a market crash in 2025, this Vanguard ETF can still make for a solid investment to put into your portfolio for the stability it offers. It can be the perfect long-term investment to buy and hold for the rest of your life and periodically add money to over the years. By broadly investing in the entire stock market, you can be well positioned to grow your portfolio, regardless of how specific sectors are doing.

Should you invest $1,000 in Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bitcoin, Microsoft, Nvidia, and Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.