Do you like bargain stocks? How does an 84% discount sound? That's how much shares of streaming-television technology company Roku (NASDAQ: ROKU) are down from their pandemic-prompted 2021 peak. This stock's barely moved since the latter half of 2022, in fact, with most investors seemingly afraid to dive in without more evidence that a rebound is underway.

As the old adage goes, though, the time to be fearful is when others are greedy. The time to be greedy is when others are fearful.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

That's the long way of saying the crowd's looking right past a great opportunity here.

Roku is the streaming middleman to beat

The prevailing worry is understandable. The company isn't profitable, after all, and unlikely to become profitable in the immediate future. Investors can also plainly see how crowded and competitive the streaming business has become.

Nevertheless, for interested buyers that can stomach the risk, Roku is still a compelling prospect at its discounted price.

But first things first.

On the off chance you're not familiar with it, as was noted, Roku is a streaming-television technology name. It manufactures the small boxes attached to your television set that let you tune into TV shows and movies available via apps like Amazon Prime, Netflix, and The Walt Disney Company's Disney+, just to name a few; many television sets are also now available with this tech already built into them.

Televisions and streaming receivers aren't its core business, though. Over 85% of its revenue and all of its gross profits actually stem from advertising and serving its middlemen for streaming services like the aforementioned Disney+ and Netflix; it also operates its own ad-supported streaming channel. Its devices are simply a means to this end.

Whatever the business model is, it's working. Data from ComScore indicates that Roku controls an industry-leading 37% of the United States over-the-top (non-cable) connected-television advertising market. In a similar vein, media market research outfit Parks Associates reports that Roku accounts for 43% of the country's actively used media-playing devices, topping Amazon's comparable FireTV tech. Roku hasn't yet put much focus on foreign markets, but where it has, it's gotten respectable traction there as well.

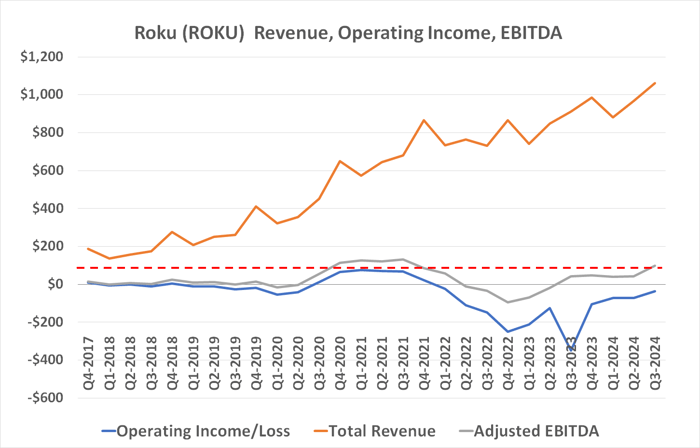

And the company is making forward progress. Revenue is still growing, and its losses continue shrinking.

Data source: Roku. Figures are in millions.

So why isn't the stock acting like this progress is being made? Keep reading.

The disconnect can't last forever

Roku stock's extreme 2020 bullishness makes obvious sense. The COVID-19 pandemic was in full swing then, keeping millions of consumers stuck at home with little else to do but watch television. And they did. In droves. For perspective, ComScore says live television viewing within the U.S. soared on the order of 70% year over year during March of 2020.

Consumers leaned on Roku in a big way to facilitate this surge in TV viewing. Media device sales jumped 35% during the second quarter of 2020 alone, while the number of active Roku accounts improved 41% to 43.0 million for the same time frame. This red-hot growth pace wouldn't cool off until the latter half of 2021.

In retrospect, though, Roku stock's 540% advance during that period was simply too much. The bear market of 2022 finally forced a much-needed full correction of this oversized gain. Indeed, the stock has barely budged since then, with many investors still shocked at the sheer scope of the setback.

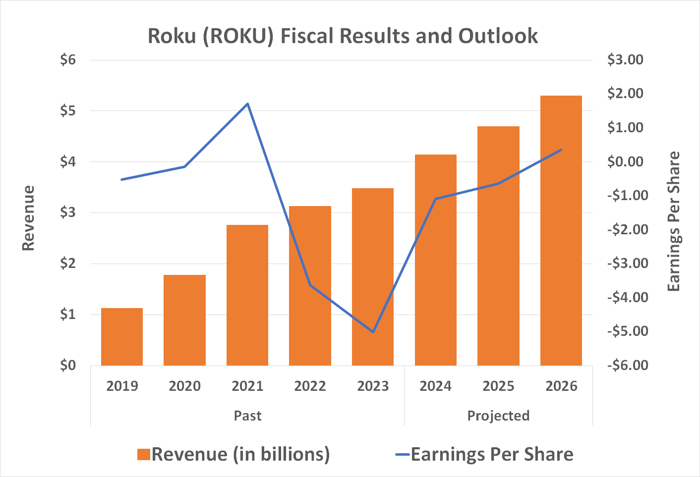

This is one of those relatively rare cases, however, where the disconnect that allowed for a much-needed correction has lingered too long. The underlying company has proven that its financial viability is possible even if it's going to take a couple more years to get there; the analyst community is calling for a swing to positive full-year profits in 2026, when the company is projected to do $5.3 billion worth of business.

Data source: StockAnalysis.com. Chart by author.

Most of that business will, of course, still be advertising revenue -- the streaming sliver of the overall ad business that eMarketer believes is set to grow at an average annualized pace of 10% through 2027. Roku is positioned to enjoy more than its fair share of this growth, leading the company out of the red and into the black during this relatively short time frame.

Investors have yet to say they agree by buying the stock to the same degree as they did in 2020 before dropping out in 2022. Analysts aren't exactly on board en masse either. The majority of them only consider Roku stock a hold, while their consensus price target of $83.13 is merely about 8% above the stock's present price. That's not much bullish help.

Neither the analyst community nor investors as a whole are always right about a stock's likely near and distant future, though. Sometimes, you've got to make a judgment most others don't quite seem to agree with. This is arguably one of those times.

Just don't tarry with Roku stock

A guaranteed winner? Certainly not. There's above-average risk paired with this particular ticker's above-average upside potential. It's also far from being a foundational, pillar kind of holding for anyone's portfolio.

There's less risk than the crowd appears to think there is, however, and arguably more reward than most are seeing. Sooner or later -- and likely sooner than later -- the market's going to have little choice but to reconnect this stock with its underlying company's ongoing growth. It would be better to have some Roku stock before that starts happening than to be forced to chase it higher once the big move finally begins unfurling.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $823,000!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Netflix, Roku, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.