AMC Entertainment Holdings (NYSE: AMC) has had a volatile few years. The pandemic forced it to close its theaters temporarily, and since that's how the company generates nearly all its revenue, the closures were devastating.

Thankfully for shareholders, the company has reopened its theaters, showing blockbuster films on the big screen again. However, the steps that management was forced to take during the initial stages of the pandemic have burdened the company with high-cost debt that will be difficult to pay off.

Let's look at the green and red flags in more detail below.

Image source: Getty Images.

Green flag: Blockbusters are thriving on the big screen

When the pandemic forced AMC to shut down its theaters, studios responded by moving back release dates on potential blockbuster titles. In some cases, studios released the films directly to streaming services, forgoing movie theaters entirely. That raised fears among AMC shareholders that studios would maintain this strategy even after the pandemic. The fears have mainly been laid to rest after several films delivered exceptional performances at the box office.

Spider-Man: No Way Home earned a whopping $1.9 billion on the big screen. Doctor Strange in the Multiverse of Madness is approaching $900 million while The Batman took in $770 million. Of course, studios would like to spruce up their streaming services by launching new films directly to the platforms. But it would not be prudent for them to pass up hundreds of millions, or perhaps billions, by skipping the big screen entirely.

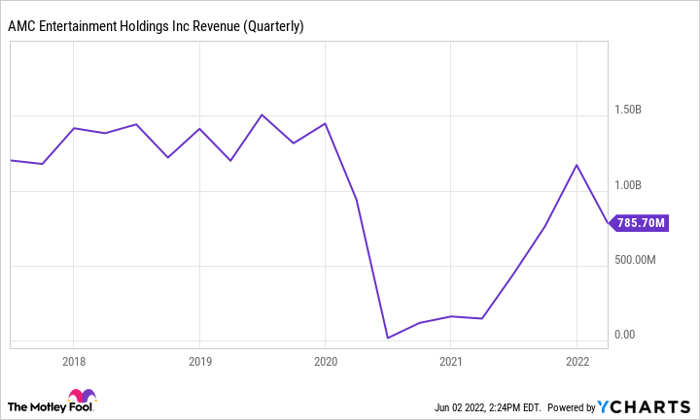

Success of that magnitude buoyed AMC's revenue to $786 million in its most recent quarter, which ended March 31. That was up more than fivefold from the $148 million it earned in the same quarter the year before. While the bounce is a green flag, to be sure, AMC's revenue is still far below levels from before the pandemic.

AMC revenue (quarterly). Data by YCharts.

Red flag: AMC has a troubling debt load

Management did an excellent job when its theaters were forced to close. It sold equity, raised debt, and negotiated rent payment extensions to ensure the company would survive. However necessary they might have been, the moves are now burdening the business with a heavy debt load. As of March 31, AMC had $5.5 billion in debt on the balance sheet. That was nearly $100 million higher than at the same time last year.

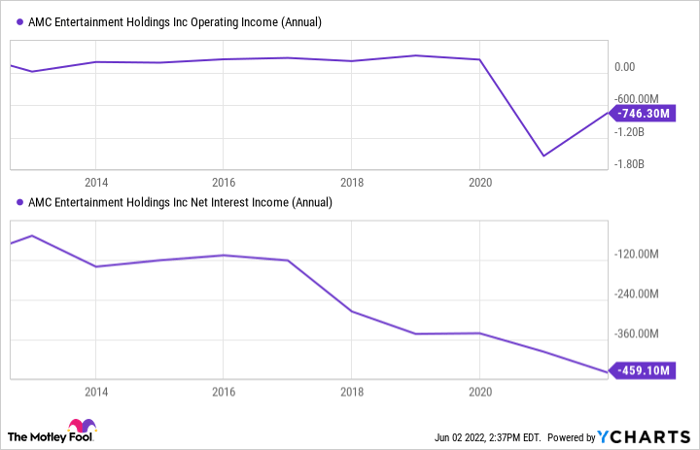

AMC operating income (annual). Data by YCharts.

In the quarter ended in March, AMC paid $82 million in interest expenses. For all of 2021, it paid $459 million of interest expenses. To put those figures into context, AMC earned $748 million in revenue in the most recent quarter and $1.4 billion in 2021. In the previous decade, the highest operating income AMC earned was in 2018 at $310 million; the next highest was $267 million. Comparing the annual interest expense with previous peak levels of operating income highlights how difficult it will be for AMC to service the $5.5 billion in debt.

Overall, the red flag is far more problematic for AMC's stock than the green flag is positive. Even though it is bouncing back, revenue is still meaningfully below pre-pandemic levels. Meanwhile, the company is still losing money on the bottom line, and interest expenses are bleeding cash from its balance sheet.

AMC lost $295 million in cash from operations in the first quarter. It has $1.16 billion in cash and equivalents as of March 31, down from $1.6 billion on Dec. 31. At this rate, it may not be long before the company approaches crisis mode again.

10 stocks we like better than AMC Entertainment Holdings

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and AMC Entertainment Holdings wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of April 27, 2022

Parkev Tatevosian has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.