There aren't too many stocks on the market that have gained 230,000% since their initial public offerings, especially without dividends and in less than 30 years. But the stocks that have done it are usually global giants that are settling down into value territory and starting up dividends.

Amazon (NASDAQ: AMZN) stands out because it has delivered this whopping gain and still has a long road ahead. The market wasn't so sure about this before artificial intelligence (AI) burst onto the scene two years ago, but in Amazon style, it has developed a robust AI platform that's becoming a massive tailwind for its business.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here's why this mega-multi-bagger stock still has a long growth runway ahead.

Why everyone is so excited about generative AI

Unless you've been living under a rock, you already know that generative AI is changing the way we do a lot of things, especially how businesses get their work done. Companies that offer generative AI services are already racking up billions, and that's expected to expand into trillions.

There are several kinds of services and solutions that business-to-business companies offer. These include hardware products like the chips that Nvidia makes and the production capabilities that Taiwan Semiconductor Manufacturing provides, as well as the software solutions that service providers like ChatGPT and Amazon are creating.

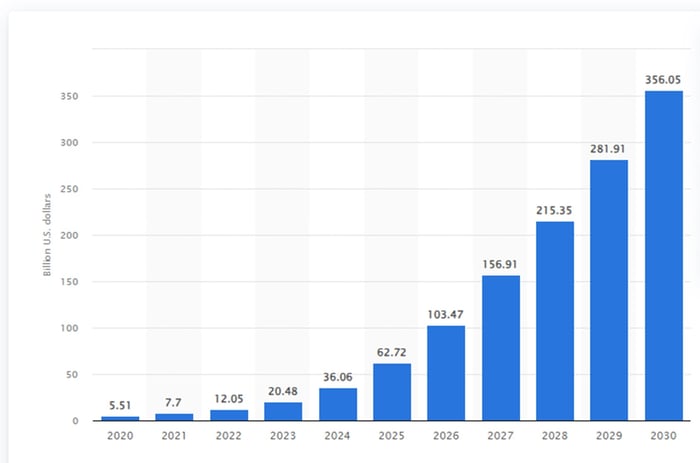

Is generative AI the next big trend that's being hyped up to change the world before it fades into oblivion? It's already making a deep impression in so many ways, like creating value for individuals and businesses through saving them time and money. According to Statista, the market is expected to grow tenfold by 2030, or at a compound annual growth rate of 46.5%. No wonder everyone is paying close attention.

Image source: Statista.

Putting some Amazon into AI

Amazon is already on the receiving end of this windfall, with its AI business generating billions of dollars for the company's coffers. CEO Andy Jassy sees this as just the beginning, with the watershed moment still up ahead. He has said repeatedly that the move to the cloud is still in its infancy, and with Amazon's robust AI platform, it will benefit from the shift in a massive way.

The e-commerce king has its signature way of doing things, and it typically involves size, reach, and budget. It launched its AI solutions business with three tiers to meet every kind of budget and be able to offer some kind of useful service for every client. Amazon Web Services (AWS) is the largest cloud computing company in the world, and management understands that it can leverage its client roster to grow its AI business and create another huge revenue stream.

The bottom tier on this platform is the creation of custom large language models (LLMs) for large clients, the middle tier offers Amazon's LLMs along with a client's data to drive semi-customized generative AI models, and the top tier, for smaller enterprises, includes ready-to-use solutions.

McKinsey notes that the development of Amazon Bedrock, in the middle tier, was one of the defining moments on the trajectory of generative AI. Bedrock links AWS client databases with Amazon and other LLMs for a seamless and effective generative AI experience.

Some of the services Amazon offers for third-party e-commerce sellers include videos created from a single image and full marketing campaigns based on prompts. While the business is service-based, Amazon is also building its own graphics processing units (GPUs), the chips that power generative AI, to compete with partner Nvidia's chips and get more customization for its budget-conscious customers.

Driving Amazon stock higher

Amazon stock fell by 50% in 2022, but it's up 166% since it bottomed out, just around the time it launched the generative AI business.

All of Amazon's businesses are climbing these days, with e-commerce increasing at a steady rate and advertising and AWS both adding greater growth to the mix. AWS still only accounted for 17% of total sales in the third quarter, but it represented 62% of operating income. Generative AI is an incredible growth driver for AWS and Amazon, and this is high-margin growth that will also pad the bottom line. 2025 could be another great year for Amazon and its shareholders, and there's much more coming long term.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $842,611!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.