Photograph by Jeff Geerling

Citi Research believes the chip sector offers big opportunities for investors after a decline in semiconductor stock prices over the past year.

Texas Instruments (ticker: TXN), Sony (SNE) and Taiwan Semiconductor Manufacturing (TSM) are some of the stocks worth buying, according to the bank's chip analyst team.

"Last year we were nervous about the stocks as fundamentals were peaking and momentum was slowing," analyst Christopher Danely wrote on Monday. "This year we are becoming more constructive as fundamentals are bottoming and semis are shipping below demand."

The iShares PHLX Semiconductor ETF (SOXX), which tracks a widely followed chip index, has declined about 11% since early June.

While Citi is optimistic about the sector, the team cautioned that a further slowdown in China remains a risk.

"If China goes into recession, we believe semis will see another big leg down. If not, we expect upside in 2H19 [the second half of this year] as semis are shipping below demand," he wrote.

Here are three Buy-rated chip stock ideas that made Citi's global top picks for 2019.

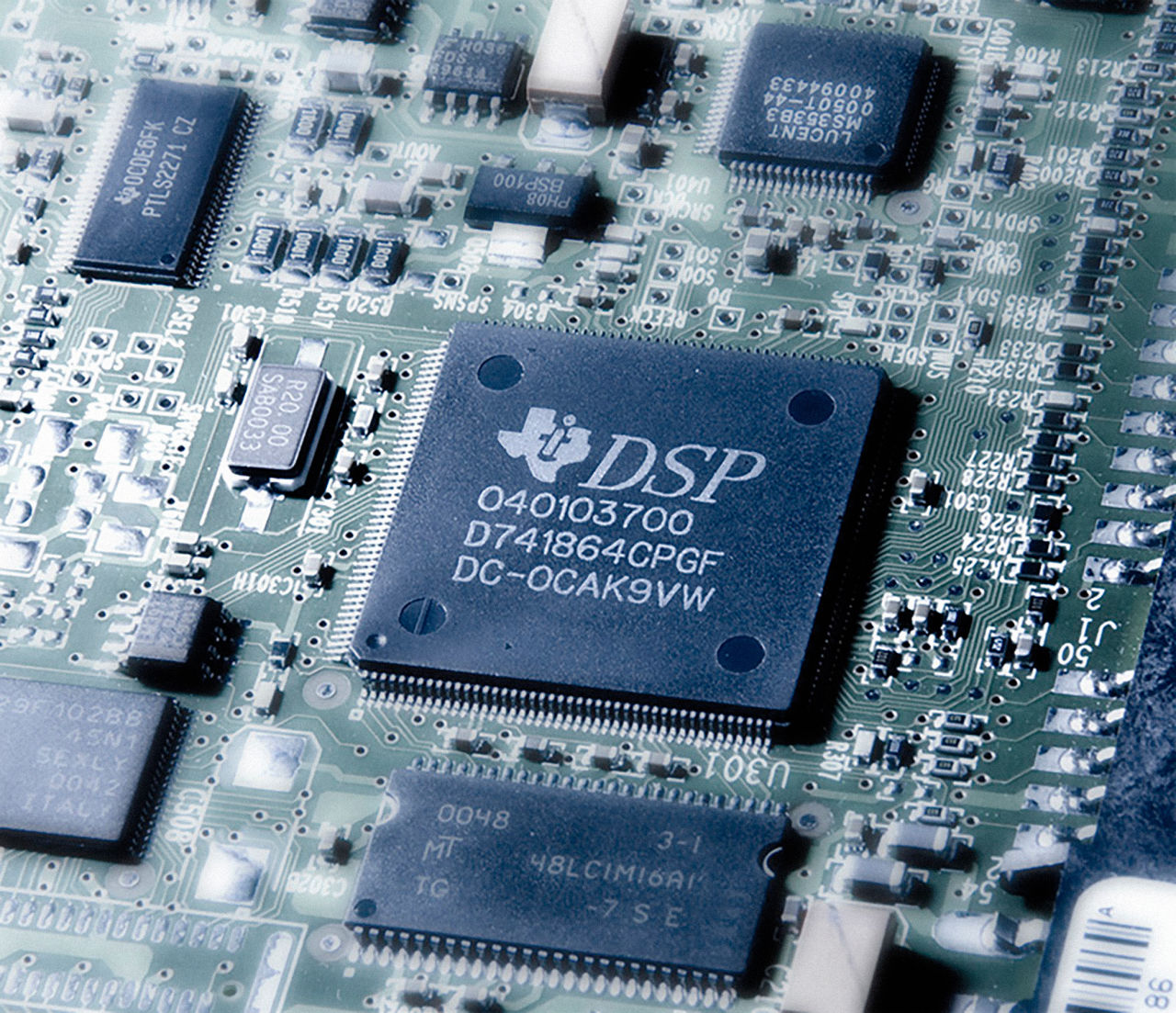

Texas Instruments

Citi has a $115 price target for Texas Instruments stock, representing about 13% upside to the current price.

Danely noted the company's shares have already had a drawdown of more than 20% in the past six months, roughly comparable to prior declines in 2012 and 2015.

"Barring a recession, we may already be near the bottom for TXN stock since this decline is similar to the recent peak," he wrote.

Taiwan Semiconductor Manufacturing

Citi has a price target of 263 New Taiwan dollars for TSMC's local Taiwan shares, about 19% higher than the current stock price.

"We believe that its technology leadership will lead TSMC to dominate leading edge nodes for the next few years," they wrote.

Sony

The firm has a 9,000 yen price target for Sony's Japan local shares, representing nearly 80% upside to the current stock price.

"Earnings have climbed to their highest level for 20 years and all of Sony's business segments have achieved notable growth or turnarounds," the team wrote. "Sony's semiconductor business continues to expand in scale and we believe profit growth is possible in this segment."

Write to Tae Kim at tae.kim@barrons.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Credit: image

Credit: image