Five Reasons Why Sovereign Wealth Funds Should be in Focus Right Now

By Andrew Gilmore, Senior Director of IR Intelligence, Nasdaq

Typically regarded as long-term, low-turnover investors with many often preferring to operate at an arms-length from the companies in which they are invested, Nasdaq IR Intelligence has observed a notable increase in buying and selling activity from sovereign wealth funds over the past year. The impact of the pandemic on global equities has meant that many sovereign funds have had to reassess their previous “buy-and-hold” approach and, instead, apply more conviction-based investment strategies. Below are five reasons why Nasdaq IR Intelligence thinks corporates should be looking to increase engagement with this group of investors in the coming months.

1. Weaker macro environment means less money to invest

The significant impact that the Covid pandemic has had on the global economy has meant that surplus assets for sovereign funds to invest will have likely become more sparse. Possible reasons for this would be the impact of lower oil demand on revenues for oil-dependent sovereign funds in Scandinavia and the Middle East or falling export revenues for non-oil dependent sovereign funds in Asia. Either way, it is quite likely there is less surplus money to go around now compared to a year ago. This means that sovereign funds may be forced to sell assets to fund growing deficits, whilst at the same time, be more targeted with their remaining investments. All this points to higher-turnover and, as such, IR teams would do well to place their top sovereign wealth fund investors into the “shareholder maintenance” category.

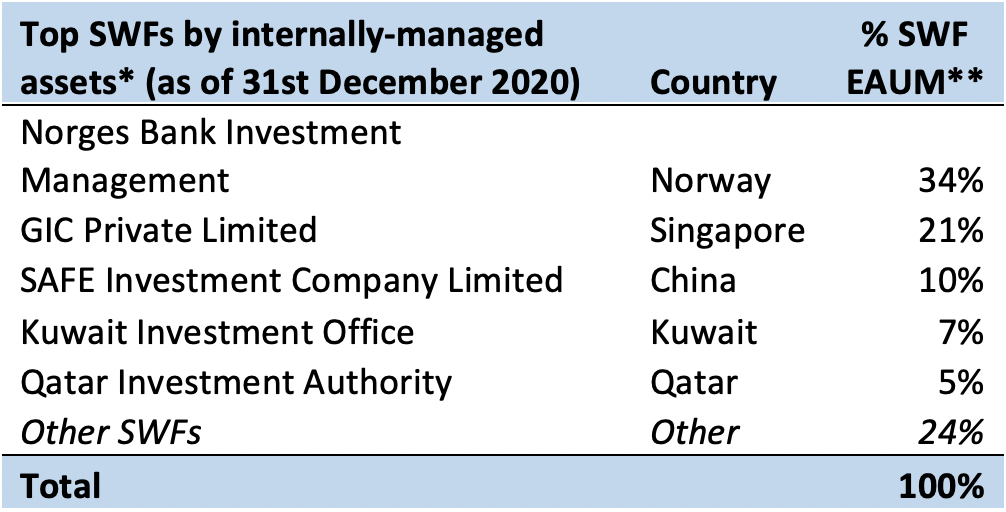

* Does not include shares held via external managers

** Source: Nasdaq IR Intelligence. Sample of shareholder analysis clients ($414bn of SWF investments held across 620 investments)

2. Paying the price for not being agile enough

The traditional “buy-and-hold” strategies adopted by many sovereign funds in the past will not have worked out well during 2020 with many having their fingers burned during the initial market sell-off in March, whilst failing to capitalize on the government stimulus-backed rebound observed in the months that followed. Subsequently, Nasdaq IR Intelligence has observed several sovereign funds becoming a lot more active in terms of making (often opportunistic) conviction purchases, while selling-down on investments where they had previously been stable, long-term holders. This is evident from the notable uptick in threshold disclosure notifications made by sovereign funds via the various regulator websites.

3. “Global value” is currently in-play

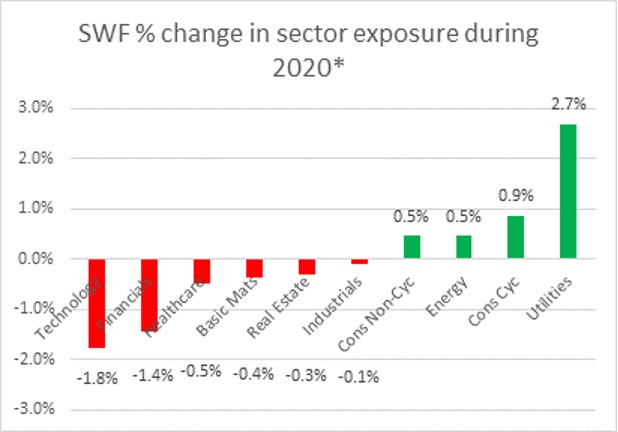

The majority of sovereign wealth funds have globally-diverse portfolios with an ability to alter their regional weightings easily due to their centrally-controlled management structures. Indeed, there have been several news articles recently detailing the intentions of several funds to adjust their regional weightings in light of the post-Covid market environment. Certainly, much has been written about the value-disconnect that exists between equity markets on either side of the Atlantic as the impact of government stimulus packages on equity markets was more effective in the US. This could mean that European companies stand to be net-recipients of sovereign wealth capital from those funds known to adopt global value strategies. According to Nasdaq IR Intelligence sovereign wealth funds appear to have pared-down their exposures to sectors that outperformed during 2020 such as Technology and Healthcare, while picking up investments in sectors that underperformed in 2020 such as Energy and Consumer Cyclicals.

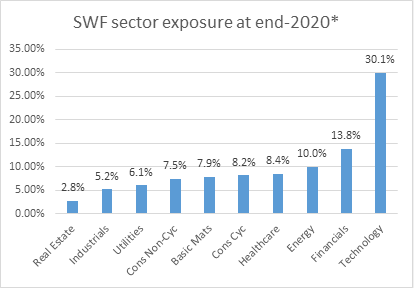

*Source: Nasdaq IR Intelligence. Sample of shareholder analysis clients ($414bn of SWF investments held across 620 investments) as of 31st December 2020

*Source: Nasdaq IR Intelligence. Sample of shareholder analysis clients ($414bn of SWF investments held across 620 investments) as of 31st December 2020

4. Increased use of external managers

2020 was a year that saw a big increase in the volume of mandate changes across the asset management industry, including some very large multi-billion dollar mutual funds ending very long relationships with their external managers as they sought lower fee structures and better overall returns. Similarly, many sovereign wealth funds appeared to have been shopping around in search of better deals and in some circumstances deciding to rotate more of their assets towards external managers, both active and passive. Corporates will have observed this activity as large shifts in holdings across their investor base, not driven by buying or selling, but rather a transfer of assets associated with the mandate changes.

5. Changes associated with ESG preferences

Sovereign wealth funds are not typically known for their engagement on an ESG level, but some noteworthy trends are now starting to emerge, which could be an indication of a greater involvement in the future. In the case of several oil-dependent sovereign funds there is a clear trend towards the de-carbonization of their investment portfolios, preferring to only retain Energy investments that are embracing the energy transition. Furthermore, there is the acknowledgement from some Middle East sovereign funds of the need to diversify their economies away from oil as the global economy looks to become carbon neutral by the middle of this century. Again, as this trend plays out, further portfolio turnover should be expected, which can present some companies with the opportunity to be the recipient of any reallocated investment capital.

So what does this mean for issuers?

Sovereign wealth funds whose share positions have previously been regarded as being stable and long-term are likely to demonstrate more volatility over the coming year as they become more active in terms of stock selection to take advantage of changing market dynamics, whilst dealing with the macro-economic factors that are having a direct impact on the amount of money they have available to invest. As such, Investor Relations teams would be advised to review their engagement strategies with this specific group of investors to enable a better understanding of the opportunities and risks that exist amongst their sovereign fund holders. In its capacity as provider of Shareholder Analysis services to many of the largest quoted companies in the world, Nasdaq IR Intelligence has a unique viewpoint into aggregate investor activity on a global basis. This can enable Investor Relations professionals to: understand the extent of sovereign wealth fund ownership across their investor base; understand the characteristics of how individual sovereign wealth funds invest, and identify the right individuals at these institutions. For more information about how Nasdaq’s Advisory team can help you to formulate an effective engagement strategy with sovereign wealth funds, please speak to your local Nasdaq representative.

Other Topics

Market IntelligenceContact the Nasdaq IR Intelligence Team