Apple is well known as Warren Buffett's largest investment at Berkshire Hathaway. It has netted shareholders over $100 billion in gains, making it one of the most successful investments ever.

However, did you know that Buffett has greatly trimmed this position? That's right -- Berkshire Hathaway has been selling Apple shares throughout 2024, likely due to the stock's rising valuation. Clearly losing his optimism about the future returns of Apple stock, Buffett is adding a ton of cash to Berkshire Hathaway's balance sheet, which now numbers over $300 billion.

There is one stock he has never sold since buying in 1991, though: American Express (NYSE: AXP). Buffett owns over 20% of the credit card issuer and bank, making it the second-largest position in the Berkshire Hathaway portfolio. The position trades at a value of $40 billion as of this writing.

Let's see why Buffett is attracted to American Express stock, why he has never sold a share, and whether you should join him and buy shares today.

A durable consumer financing institution

Buffett has been following American Express ever since he first bought shares in 1963. Back then it was a radically different company, dealing in traveler's checks. By 1991, the company had become one of the largest credit card networks in the United States, focusing on serving a premium customer base.

There are a few durable qualities to American Express' business model. It sells high-fee credit cards such as the Platinum card, which debuted in 1984. People sign up for these cards because of the travel benefits and premium perks such as access to airport lounges. However, they also come with an intangible brand benefit built up over the last few decades. Customers feel like they are in an exclusive club shopping with the metallic American Express cards, which gives the company a brand value that is tough to replicate.

On the back end, the American Express infrastructure is hard to replicate. Like Visa and Mastercard, American Express has been entrenched as a payment method for merchants for decades. If another credit card network were to try to compete, it would have to go to virtually every merchant across the country to try to convince them to add another credit card to its payment terminal. This is an uphill battle that insulates American Express from the competition.

Buffett likely saw these qualities in 1991 when he bought American Express for Berkshire Hathaway. Since then, American Express stock has posted a cumulative total return of 10,130%. Even though Buffett has only purchased more shares a few other times since 1991, the stock has compounded at such a high rate that it now makes up a large portion of his equity portfolio.

Buffett's never-sell mentality

Many, perhaps most, people have sold American Express while Buffett remains a shareholder. This is a lesson for beginning investors: You don't generate wealth by buying a stock, but by holding it for the long term.

Buffett espouses this mentality for what he deems the best businesses in the Berkshire Hathaway portfolio. As long as he believes American Express stock isn't getting to an unreasonable valuation and still has plenty of runway left to grow, he believes the best course of action is to just hold. Long holding periods for your big stock winners is a lesson investors should take away from studying Buffett, with American Express being the quintessential example.

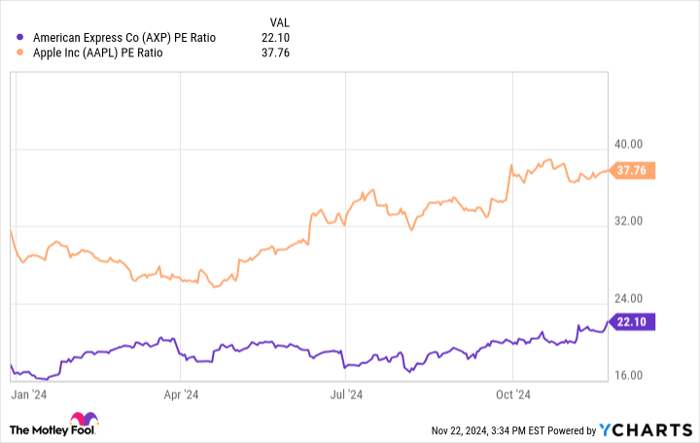

If you think this contradicts the Apple sales, readers should note that Apple is still Buffett's largest stock holding today. He likely didn't want too large of a position in a slow-growth company trading at a price-to-earnings ratio (P/E) of 37. American Express still has plenty of runway left to grow, especially with its permanent inflation hedge. As a take-rate of the entire payments space in the United States (and increasingly around the world), American Express' revenue grows along with inflation.

AXP PE Ratio data by YCharts

Is American Express a buy today?

American Express stock is having a phenomenal year, up 58% year to date (YTD) as of this writing. The stock has a P/E of 22, which is much lower than Apple but higher than its historical average.

Even so, I think American Express can do well by shareholders over the long term. Management believes it can grow earnings per share (EPS) at around 15% through acquiring new customers, inflation, pricing power, and its robust share repurchase program. Even if the stock's P/E compresses, investors should benefit by holding it over the long term -- which is why Buffett isn't selling a single share.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $833,545!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

American Express is an advertising partner of Motley Fool Money. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.