Despite its social stigma and terrible health consequences, tobacco is arguably the most lucrative business the world has ever seen. The U.S. Surgeon General first warned the American public about the dangers of smoking on Jan. 11, 1964. Since then, smoking prevalence in the United States has steadily declined.

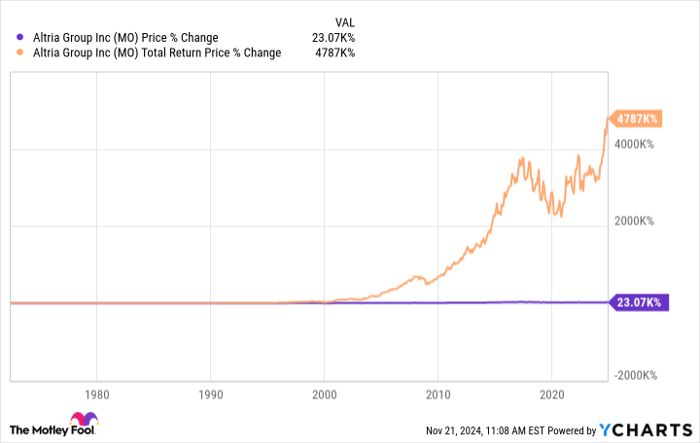

Yet, Altria Group (NYSE: MO), which sells the leading cigarette brand (Marlboro) in the United States, has turned a one-time $100 investment made in 1972 into more than $4.8 million today.

The company has changed over the years, including spinning off its international operations as Philip Morris International in 2008. Still, Altria's strategy of steadily raising prices on its addictive core product has kept the company and stock very relevant.

So, can the stock still make you rich? Here is what you need to know.

Marlboro and dividends drive Altria stock

In the late 1980s, investing great Warren Buffett remarked that he liked the cigarette business because cigarettes are cheap to make, can be sold at high margins, and have addictive properties that result in strong brand loyalty. This explains how the Marlboro brand has generated staggering wealth through Altria stock over the years. To this day, Marlboro still holds an estimated 41.7% market share in America.

Altria has very little overhead. It can't even advertise much, due to strict tobacco laws. Therefore, Altria has spent decades sending most of its cash profits to shareholders as dividends. The tobacco industry faces continuous scrutiny, litigation, and rumors of new regulatory threats.

It's a unique situation where a company pays a generous dividend, and the constant pessimism around the stock inflates the yield even higher. Altria's long-term dividend yield averages about 9.5%. On top of that, Altria's ability to grow profits by raising prices enough to offset slowly shrinking cigarette volumes has made Altria a Dividend King, with over five decades of continuous dividend raises.

I don't want to take away from Altria's historical price appreciation -- the stock has done well. However, reinvesting that remarkable dividend, with its abnormally high yield and continual increases, is why Altria's total returns are off the charts.

The good news? Altria's dividend, the engine that drives the stock, remains intact. The dividend payout ratio is a manageable 80% of Altria's 2024 earnings estimates. Analysts estimate that Altria will grow earnings by 3% to 4% annually over the next three to five years, so there's a good chance the dividend will continue growing just fine. If not, Altria has an investment-grade balance sheet, and a multi-billion-dollar equity stake in Anheuser-Busch that it could liquidate in a pinch to raise funds.

Despite all this, I don't think Altria will come close to repeating its past success

The tobacco industry is finally staring at meaningful change. Cigarette use in the United States has declined at a slow burn (pun intended) for decades, mainly because there weren't many alternatives for smokers. But that has changed over the past decade. Smoke-free nicotine products have popped up, such as electronic cigarettes (vaping), oral nicotine pouches, and heat-not-burn tobacco devices. Now, people who want to quit smoking have several choices to get their nicotine fix.

It's a new paradigm for the tobacco industry, a threat Altria has never seen before. A battle for market share among these next-generation products could shuffle the industry's competitive landscape. And Altria, whose Marlboro brand is the leading cigarette name and the company's golden goose, could lose share to smoke-free alternatives. If so, it could steeply worsen Altria's uphill battle against declining cigarette volumes.

To be clear, Altria will compete across vaping, oral nicotine, and heat-not-burn devices with its versions. However, it's arguably slow to the smoke-free game right now. Altria still derives 88% of its net revenue from smokeable products (cigarettes and cigars), so it's very much behind in this shift compared to Philip Morris International, which has converted 38% of its net revenue to smoke-free products. Plus, smoke-free products have exposed Altria to competition from Philip Morris International, which owns the U.S.'s leading oral nicotine pouch brand (Zyn) and is gearing up to launch its heat-not-burn IQOS device in the U.S. market.

Which investors are best suited for Altria stock today?

The Marlboro brand and magnificent dividend that made Altria stock so great are still there and should be for the short to medium term. But you need time to reinvest that dividend and benefit from the compounding that makes you rich with a stock like Altria.

The tobacco industry's shift to smoke-free products won't happen overnight, but it is happening.

That makes it difficult to maintain confidence in Altria beyond the next five to 10 years. The dividend's short-term stability makes Altria stock an excellent idea for retirees or income-focused investors who want passive income now and aren't as worried about these far-out concerns.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

Justin Pope has positions in Philip Morris International. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.